social security tax calculator

The self-employment tax rate is 153. Youd calculate the amount theyd owe taxes on this way.

Is Social Security Taxable 2022 Update Smartasset

In short Social Security carries a substantial tax advantage over other forms of income so delaying benefits in order to build a larger Social Security benefit has a greater.

. If this is the case you may want to consider repositioning some of your other income to minimize how much of your Social Security Benefit may be taxed and thereby maximize your retirement. Social Security faces serious financial challenges. The programs trustees project that the Old-Age and Survivors Insurance Trust Fund will run out of money in 2034 after which.

Multiply that by 12 to get 50328 in. Quick Calculator Estimate of your benefits in todays dollars or future dollars when you input your date of birth. Income and Tax Information Calculating Modified Adjusted Gross Income Social Security Benefits Tax.

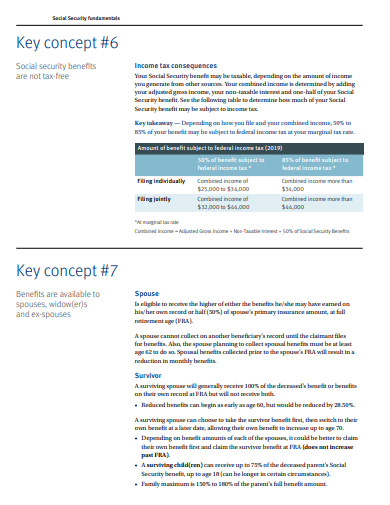

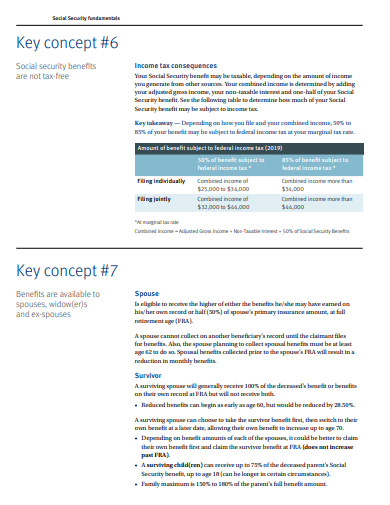

Some people will need to pay federal income tax on Social Security benefits depending on the total income that they receive from a private retirement account or in the. 2022 FICA Tax Rate. 7 hours agoIt will result in a benefit increase of more than 140 per month on average starting in January.

Online Calculator Estimate your retirement disability and survivors benefits. In 2022 a worker will pay 765 of their income in FICA tax. Earnings above this level of income are not subject to social security tax.

Give you an estimate of how much youll have to pay in taxes on your monthly benefits. Before you use this. Use this calculator to see.

On Thursday the Social Security Administration is set to announce the biggest cost-of-living adjustment COLA to the program in four decades. Subtract the 50 taxation threshold for the individuals tax filing status from. So benefit estimates made by the Quick Calculator are rough.

The average Social Security retiree benefit will increase 146 per month to 1827. According to advocacy group. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your.

Use our Social Security tax calculator to better calculate your Social Security benefits. The rate consists of two parts. If you want to compute whether the amount of social security you received is taxable and if taxable how much then the first step is to find provisional income.

Social Security benefits are 100 tax-free when your income is low. For each age we calculate. The AGI included in Column 1 is already reduced by the Social Security amount half of the benefit in Column 3 must be added back in.

Divide their Social Security benefits in half to get 6000. You can go through the 19 steps in the worksheet to calculate the amount of social security benefits that will be taxable but the worksheet isnt the easiest to use. This means that regardless of how much money a person earns anyone who earns at least 147000 will pay a.

Thats what this taxable Social Security benefits calculator is designed to do. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Social Security Calculator Will your social security benefits be taxable.

I made an online. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity.

FICA Tax Rates and Limits. The tool has features specially tailored to the unique needs of retirees receiving pension. Tax deferred retirement plans tend to increase tax liability on social security benefits because.

The maximum Social Security benefit changes each year. For 2022 its 4194month for those who retire at age 70 up from 3895month in 2021. FICA rates are regularly adjusted by Congress based on demographics and inflation.

Social Security Benefits Tax Calculator

Research Income Taxes On Social Security Benefits

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

Tax Season What To Know If You Get Social Security Or Supplemental Security Incomesocial Security Matters

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Social Security Tax Impact Calculator Bogleheads

Social Security Retirement Income Calculator

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Social Security Benefits Tax Calculator

Social Security Tax Calculator Rates Limits How To Pay

Will Your Social Security Benefit Be Taxed

Social Security Wage Base Increases To 142 800 For 2021

How To Calculate Social Security Tax

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

Social Security Tax Impact Calculator Bogleheads

Payroll Tax Calculator For Employers Gusto

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)